Texas Title Loan storefronts offer personalized refinancing for diverse financial needs, optimizing loan terms including lower rates and shorter durations without new applications. Eligibility requires being 18+, providing valid ID, verifiable income, and collateral (vehicles) while credit history is less crucial. Storefront visits streamline the process, with specialists conducting vehicle inspections to tailor repayment plans, making refinancing accessible and convenient.

Looking to refinance your loan with a Texas title loan storefront? This guide breaks down everything you need to know. Discover how refinancing can help manage your debt and save money. We’ll explore the eligibility criteria for TX storefront refinances, outlining the simple steps to secure a new loan at a local title loan office. Maximize your financial well-being by understanding your options today.

- Understanding Refinancing at Texas Title Loan Stores

- Eligibility Criteria for Storefront Refinances in TX

- Steps to Refinance Your Loan at a Local Title Loan Office

Understanding Refinancing at Texas Title Loan Stores

Refinancing through Texas Title Loan Storefront Locations offers a unique opportunity for individuals seeking to optimize their loan terms. These stores cater to a range of financial needs, providing both traditional and alternative lending solutions. By refinancing, borrowers can potentially secure lower interest rates, shorten loan durations, or access additional funds without the hassle of a completely new loan application process.

Texas Title Loan storefronts facilitate this process by allowing borrowers to directly interact with lenders. This personal approach simplifies complex financial decisions, especially for those who prefer a more traditional banking experience. Moreover, refinancing can be particularly beneficial for individuals holding existing Fort Worth loans, enabling them to explore options for reducing their monthly payments or accelerating loan payoff through strategic refinancing terms.

Eligibility Criteria for Storefront Refinances in TX

When considering a refinance at Texas title loan storefront locations, understanding the eligibility criteria is essential. To qualify, borrowers typically need to be 18 years or older and have a valid government-issued ID. Income and employment verification are also required, although specific standards may vary between lenders. Having a steady source of income, such as from a job or retirement benefits, significantly increases your chances of approval.

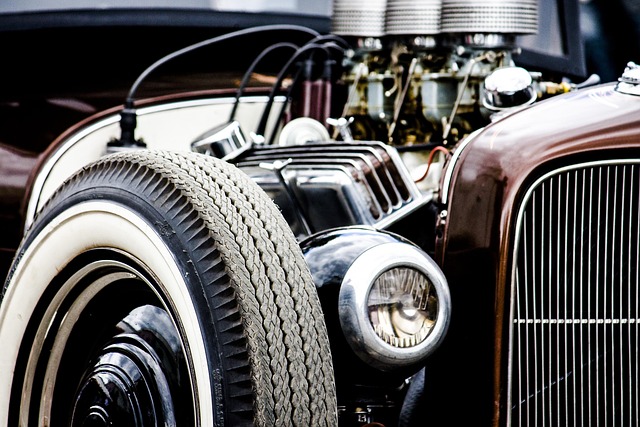

In terms of collateral, Texas title loan storefront locations usually accept vehicles, including cars, trucks, and motorhomes, as security for the loan. The vehicle’s value should be sufficient to cover the refinance amount. Unlike traditional loans, your credit score doesn’t play a significant role in this process, making it an attractive option for those with less-than-perfect credit or no credit history who may need emergency funds, such as those offered through Fort Worth Loans, or require car title loans to manage unforeseen expenses.

Steps to Refinance Your Loan at a Local Title Loan Office

Visiting a Texas Title Loan storefront location is an efficient way to refinance your existing loan. The process begins with scheduling an appointment at your nearest office. Upon arrival, knowledgeable staff will guide you through each step, ensuring a smooth experience. They’ll assess your current loan and discuss available repayment options tailored to your needs, whether it’s a Semi Truck Loan or another vehicle-backed financing.

During your visit, a specialist will perform a quick vehicle inspection to verify the condition of your asset, which is crucial for refinancing. After confirming all details, you can agree on new terms and conditions, potentially reducing your interest rates and repayment periods. This local approach offers personalized assistance, making it convenient and accessible for those seeking loan refinancing in Texas Title Loan storefront locations.

Refinancing through a Texas title loan storefront location can be a strategic move to simplify your repayment process and potentially save money. By understanding the eligibility criteria and following the outlined steps, you can take advantage of this option. Remember, comparing rates and terms from various lenders is key to making an informed decision when refinancing any loan, including Texas title loans.